Perhaps you’ve seen this statistic tossed around on Linkedin and don’t understand it.

Or maybe you already have a deep understanding of the 95:5 Rule in B2B marketing.

Either way, this article is for you if you want to understand the nuances of the research, how B2B buyers buy, and the ins-and-outs of buyers depending on the stage that they’re in.

What is the 95:5 Rule?

The 95:5 Rule states that only 5% of a target addressable market category is actively looking to buy at any given quarter while the other 95% are out of the market – not ready to buy the category’s service or product. In other words, only 20% are in market any given year and 80% will become buyers in the next 4 years.

The research that produced this rule was conducted by the Professor John Dawes, at the Ehrenberg Bass Institute.

The 95:5 Rule can be considered as a heuristic – a rule that is not 100% perfect but “good enough” to make thinking about the market easier and faster. Very similar to different mental models in marketing, like the buying journey or the Pareto Principle.

That’s because it can depend on your category. In some categories, maybe only 2% are ready to buy every quarter. And maybe in other categories, 10% are ready in any given quarter.

If you know the average interpurchase time for your category, you can calculate an estimate of the % that are in-market.

For example, if your category has an average purchase time of 3 years. That means that 33% are in market during one year, or 8.25% each quarter.

Despite this percentage being different for each category, the key point to remember: most buyers in a market are future buyers.

But why does this matter so much for our marketing strategy and approach?

First, you need to understand why buyers are out-of-market in the first place.

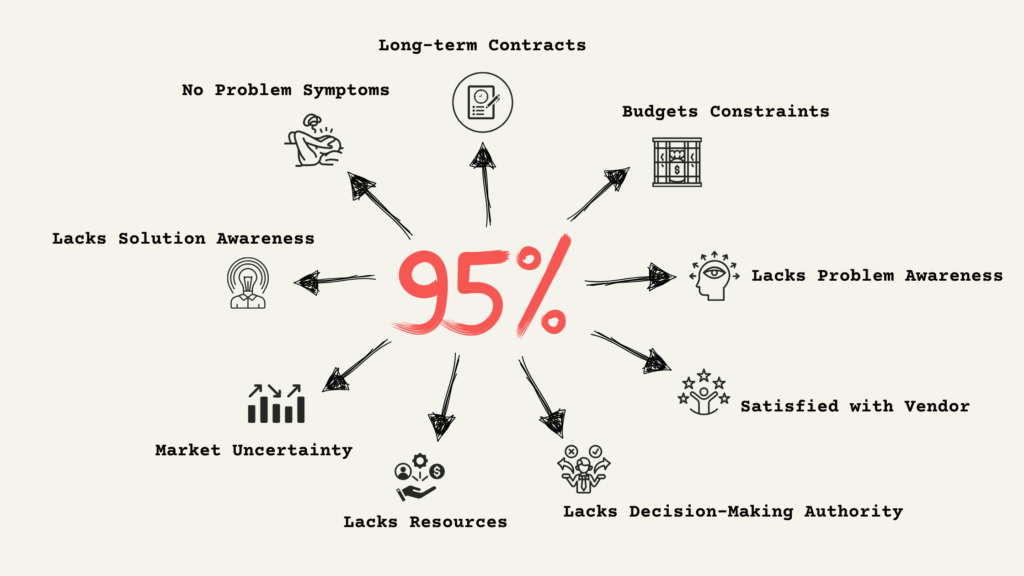

For Which Reasons is a B2B Buyer Not In-Market?

Here are examples for each of the reasons a B2B buyer might be out of market:

- Not experiencing any of the symptoms of the problem

Example: A company manages their projects perfectly fine in their Slack channels, so they don’t feel the need to invest in a new project management software like Asana or Monday.com. They haven’t encountered issues like delays, miscommunication, or inefficiency, so they aren’t motivated to look for a solution.

- Locked into a long-term contract

Example: A mid-sized company has signed a five-year contract with a CRM provider, which includes penalties for early termination. Even if a competitor offers a better deal, they aren’t willing to break the contract or endure the penalties to switch vendors.

- Budget constraints

Example: A small business is aware that it needs a cybersecurity upgrade to protect against potential threats, but their current financial situation won’t allow them to make any new software investments for at least another year. They’re forced to hold off until budget frees up.

- Lack of awareness of the problem (the root cause of their symptoms)

Example: An eCommerce company is seeing declining sales and blames it on market conditions, unaware that their real problem lies in a poorly optimized website and slow load times. Until they understand the true cause of the decline, they won’t actively seek out website optimization tools or services.

- Satisfied with current vendor

Example: A logistics firm has been using the same fleet management software for over 10 years. Although there are newer, more efficient tools available, they’re content with their current provider, who has consistently met their needs. As a result, they don’t feel the need to explore alternatives.

- Lack of decision-making authority

Example: A mid-level IT manager in a large corporation sees inefficiencies in their current cloud storage system. However, the decision to switch to a new provider rests with the CIO, who has not prioritized storage upgrades this year. As a result, no action is taken, and the company remains out of the market for a new solution.

- Lack of resources (i.e., time)

Example: A startup is aware that they need a more robust marketing automation platform, but the team is too small and overworked to dedicate time to researching, implementing, and training on a new system. Until they have more resources, they’ll continue using their outdated tools.

- Market uncertainty

Example: A manufacturing company is concerned about the potential impact of an upcoming economic downturn. They’re holding off on major investments, including purchasing new production software, until they have a clearer picture of the market’s future.

- Lack of awareness of solution

Example: A retail business is manually tracking their inventory and experiencing frequent errors. However, they don’t know that a category of inventory management software exists that could automate the process, eliminate errors, and save time. Since they don’t know there’s a solution to their problem, they aren’t looking for one.

Each of these scenarios shows how B2B buyers often face specific circumstances that prevent them from actively being in the market for a solution, despite potentially needing one.

How B2B Buyers Buy

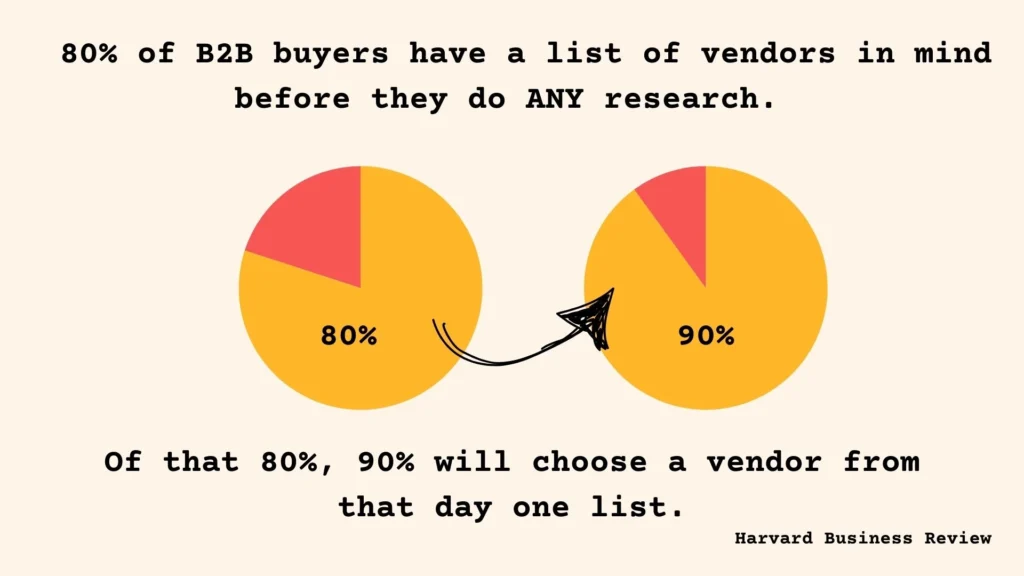

According to the Harvard Business Review, 80% of B2B buyers have a list of vendors in mind before they do ANY research. And of that 80%, 90% will choose a vendor from that day one list.

The reason this statistic matters so much to the 95:5 Rule is that if in-market buyers are not aware of your brand before they become in-market, there’s a very low chance of your brand being selected.

The human brain is the best search engine – when buyers face a problem, they usually have a “day one list” or “consideration list” of brands for potential solutions. And if your brand is not on that list (usually 3 to 5 brands), then it’s extremely hard to show the buyer why you’re any better.

Does the 95:5 Rule Apply to All Categories?

The 95:5 Rule isn’t a one-size-fits-all, but it comes close. In established B2B categories like:

- CRM systems

- legal services

- banking

… the rule is pretty spot-on.

Buyers in these mature markets know what they need, and they’re typically only shopping around when their contracts are up, or a glaring issue forces them to.

However, in newer, less obvious categories, things are a little different.

When buyers don’t even realize they have a problem (aka a non-obvious problem)—let alone what solution exists to solve it (aka a non-obvious solution)—the 95:5 balance might shift. In these cases, part of your job is to help educate them on why they need a solution in the first place.

Using one of the examples from earlier:

An eCommerce company could be seeing declining sales and blames it on market conditions, unaware that their real problem lies in the fact that they’re using an outdated strategy for their website. And until they understand the true cause of that decline, they won’t actively seek out the category of solution: website optimization.

This doesn’t necessarily mean that you can convince buyers to buy now. But it does mean that you have more of an influence than other categories.

How to Adapt Your Marketing to the 95:5 Rule

To win with the 95:5 Rule, you need to tailor your marketing to both the here-and-now buyers and the not-yet-ready crowd.

For the 95% (Out-of-market buyers): Focus on building your brand so you’re remembered when they do need a solution. This means making your brand memorable, relatable, and associated with the specific problems your audience faces. Use emotional, story-driven marketing to leave a lasting impression.

For the 5% (In-market buyers): Hit them with direct, no-nonsense messaging that speaks to their immediate needs. They’re shopping, so make your pitch clear, rational, and benefit-focused.

We wrote a while guide and playbook on the subject here – B2B Brand Marketing: A CMO’s Guide.

Difference in POV on 95:5 Rule: Brand Marketers vs. Demand Gen

Here’s where things get interesting. Brand marketers and demand gen teams often don’t see eye to eye on the 95:5 Rule.

Brand marketers see the 95% as future buyers that simply can’t be convinced into buying. They will buy eventually, and you need to be the brand they think of when they start the search.

Demand gen argues that the 95%, more or less, can be convinced to buy now and need to be educated about the problem that their solution solves.

Our argument?

The key is to marry these two approaches. Without brand marketing, demand gen has a much harder time converting those buyers. You need the brand to lay the groundwork. So when the 95% do become part of the 5%, they’re already sold on your solution.

For more obvious solutions to obvious problems, where they become problem-aware on their own (think: banking) brand marketing will have a bigger impact.

But for more non-obvious problems, where buyers need help becoming aware of the root problem that’s causing them their pains (think: consulting), then demand gen is very much needed.

We talk about the difference between obvious and non-obvious problems in our B2B Brand Marketing Guide as well.

Conclusion

The 95:5 Rule forces you to think bigger. You’re not just marketing to today’s buyers; you’re planting seeds for tomorrow. If you focus all your energy on the 5%, you’re missing out on the majority of your audience who will buy eventually.

So, make your brand unforgettable. Because when that 95% finally becomes ready to buy, you want to be the brand they already know, like, and trust as the solution to their problem.

p.s. If you want to watch an awesome interview of one of the leading minds on the 95:5 Rule, this is a great podcast episode of Tyrona Heath, Director at the B2B Institute.